What is a Mutual Fund Chain? Components, Process, and Benefits Explained

There are many important concepts in mutual fund investment. All these important concepts are interconnected in each fund. Mutual funds are an easy and safe way to invest. In the previous article, we had detailed information about what a thematic fund is, and how these funds work. In today's article, how does the process of mutual funds work overall? What is a mutual fund chain? We will give detailed information about which components work together in this chain.

What is a mutual fund?

Mutual funds are a system that collects money from many investors and invests it in various places like the stock market, bonds, gold, and government securities. This investment process is run by a professional fund manager. The profit or loss in this is shared among all investors.

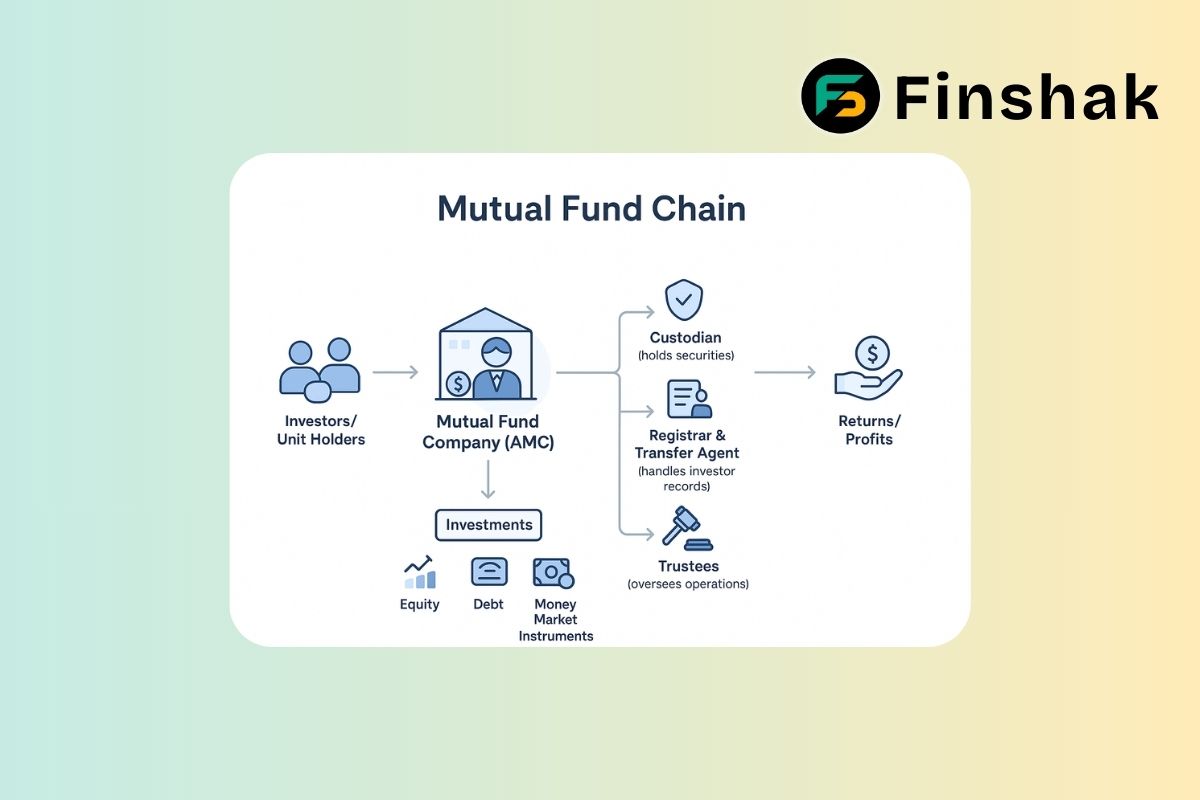

Components of Mutual Fund Chain:

This chain is as follows:

1. Fund Management Company (AMC):

AMC (Asset Management Company) is the company that creates mutual funds. E.g., SBI Mutual Fund, HDFC Mutual Fund.

This company decides the objectives of the mutual funds they have (e.g., investment in the share market, bonds, and securities).

AMC can appoint one or more fund managers. Fund managers are highly educated; they manage all the investments and decide where to invest the money.

2. Supervisors: Trustee and Custodian:

The trustee monitors the work of the AMC. They check whether the rules are being followed. They also ensure that the investors' money is safe.

Custodian:

This is a bank or institution that is appointed by the mutual fund trustee. The custodian keeps the assets (shares, bonds) of that fund safe. E.g., HSBC, ICICI Securities.

3. Distributors:

Many mutual fund companies appoint distributors to sell funds. Distributors get a commission for selling funds. Along with this, they advise investors.

4. Investors:

You and I, as well as retail investors (common people) and institutional investors (companies, insurance companies), are all investors.

5. Fund assets (internal investments):

Ultimately, the money in the fund is invested in stocks, bonds, gold, etc. The fund's profit depends on the performance of these assets.

Let us shortly understand the role of each component:

AMC: Creating new mutual funds and managing the fund

Trustee: Protecting the interests of investors and monitoring the functioning of the fund.

Custodian: Safeguards the assets and checks the transparency of the fund.

Distributors: Deliver funds to the customers and provide information.

SEBI: Sees if all the rules are followed.

Use of technology:

1. Investment decisions are made using algorithms and artificial intelligence with the help of robo-advisors.

2. Investment can be made at a low cost using an app or website made by AMC and mutual fund distributors.

3. Technology like blockchain is used to keep this secure record.

Advantages of Mutual Fund Chain:

1. Easy investment: Investment can be started through SIP from 500 per month.

2. Diversification: Investment can be made in many places at the same time.

3. Transparency: Due to SEBI rules, fund information is available to everyone.

Challenges:

1. Mis-selling:

"Some funds launch different funds in the market only for commission, due to which many customers fall prey to their marketing and invest in those funds.

2. Market Conditions:

Any financial crisis has an impact on all stock markets, which can cause your fund price to go up or down.

Future developments in the mutual fund chain:

1. AI: Computer systems will help manage funds.

2. Green or sustainable investment: Investing in environmentally friendly companies (ESG funds).

Conclusion:

The mutual fund chain is a well-organized system that makes your investment safe and successful. Mechanisms like trustees and custodians play an important role in this, making mutual funds one of the most transparent investment vehicles.

FAQ:

1. Who is the custodian of SBI Mutual Fund?

Ans: HDFC Bank and SBI-SG are two institutions appointed as custodians of SBI Mutual Fund.

2. Who is the custodian of ICICI Prudential Mutual Fund?

Ans: Deutsche Bank AG, HDFC Bank Limited, HSBC, SBI-SG, Citibank N.A., etc. Indian as well as global institutions are working as custodians.

3. Who is the trustee of SBI Mutual Fund?

Ans: SBI Mutual Fund Trustee Company Pvt. Ltd. has been formed as a trustee by SBI Bank and Amundi AMC.

4. What is AMC?

Ans: The full form of AMC is Asset Management Company. The main function of AMC is to create new funds and manage those funds.

5. Which mutual fund distributor is good in Maharashtra?

Ans: Finshak India has emerged as the best mutual fund distributor in Maharashtra.

General Blog

- ICICI Prudential Conglomerate Fund NFO 2025:

- SIP vs Lumpsum: Which Investment Strategy Is Right for You?

- Bharat Bond ETF: Safe Investment Option in India for Stable Returns

- Shariah-Compliant Mutual Funds: Who should Invest?

- Index Funds:Types, Advantages, Disadvantages & Who Should Invest

- Liquid Mutual Funds: Safe, Quick, and Rewarding Investments in 2025-26

- Portfolio Management Services (PMS)? Why is it needed?

- Hedge Funds in India: Definition, How They Work, and its Benefits

- What is Quant Mutual Fund? Meaning, Features, Types, Advantages

- What is a Thematic Fund? Meaning, Benefits, Risks & Examples in India

- Hybrid Mutual Funds: Types, Benefits, and Risks in India

- ITR Filing FY 2024-25 – Is It Mandatory if Income is Below ₹2.5 Lakh?

- What is a Debt Fund? Types, Risks & Benefits Explained

- Mutual Fund Performance and its Metrics

- How to Review Your Mutual Fund Portfolio

- Axis Mutual Fund Front-Running Scam|Who is Viresh Joshi?

- Role of Fund Manager in Mutual Funds

- Importance of Diversification in Mutual Funds

- Mutual Fund Fees – Impact Explained | Finshak

- How to choose the Best Mutual Fund

- How to Start Investing in Mutual Funds

- Risk Involved with Mutual Funds

- Benefits of Investing in Mutual Funds

- What is NAV in Mutual Fund?

- What is a Mutual Fund and ETF?

- What is a Mutual Fund?

- 5 TIPS FOR FINANCIAL PLANNING FOR WOMEN

- Growth V/s Value Investing: Which One To Choose?

- Top 3 Benefits Of Sip In Mutual Funds

Insurance

Mutual Funds

- Future of Investing in India: Specialized Investment Fund (SIF) Explained:

- Exit Load in Mutual Funds Explained: Types, Calculation, and Latest Rates

- Load Mutual Fund vs No-Load Mutual Fund: Which is Better for You?

- Load Mutual Funds vs No-Load Mutual Funds: Which is Better for You?

- The Role of Mutual Funds in Financial Planning: Diversification, Wealth Creation & More.

- What is a Mutual Fund Chain? Components, Process, and Benefits Explained

- TREPS in Mutual Funds: Meaning, Benefits & Why Funds Invest in It

- Expense Ratio in Mutual Funds: Meaning, Calculation & Impact on Returns

- SWP in Mutual Funds: How to Get Monthly Income Like a Salary from Your Investment

- Systematic Transfer Plan Explained with Types & Benefits

- What is SIP? How Does Systematic Investment Plan Work?

- Gold Mutual Funds in India: Benefits, Risks, Returns & Why You Should Invest

- Growth Fund in India 2025: Meaning, Benefits, Risks & How to Invest

- What is an Equity Mutual Fund? | Types, Advantages & Top Funds in India 2025

- TOP Mutual Fund AMC in India

- History of Mutual Fund

Popular Investment Schemes

- Senior Citizen Saving Scheme (SCSS) - Benefits & How to Invest

- Sukanya Samriddhi Yojana (SSY) 2025: Benefits, Eligibility & How to Apply

- Smart Retirement Planning with SIP: Retire Strong, Retire Free

- Post Office Time Deposit: Schemes, Interest rate, Benefits

- Everything You Need to Know About the National Pension Scheme (NPS) in India

- Kisan Vikas Patra Scheme:

- Pradhan Mantri Vaya Vandana Yojana: Secure Your Retirement with a Guaranteed Pension

Product Blog

No posts found in this category.

Stock Market

No posts found in this category.