SWP in Mutual Funds: How to Get Monthly Income Like a Salary from Your Investment

In a country like India, various investment options exist, such as fixed bank deposits, buying gold or silver, and investing directly through the stock market. Some might also invest in mutual funds. Every investor has a different purpose and objective for his investing. All these investments have different characteristics. Investment in the bank or buying gold or silver might little less risky, and investing in the stock market is more dangerous but it has a high return capacity. Mutual funds are an investment vehicle that has fixed income i.e. low-risk funds and funds that give high returns. In addition, there is a concept in mutual funds that is a Systematic Withdrawal Plan (SWP). In today's article, we will get detailed information about what is SWP? How does it work? What are its benefits?

What is SWP?

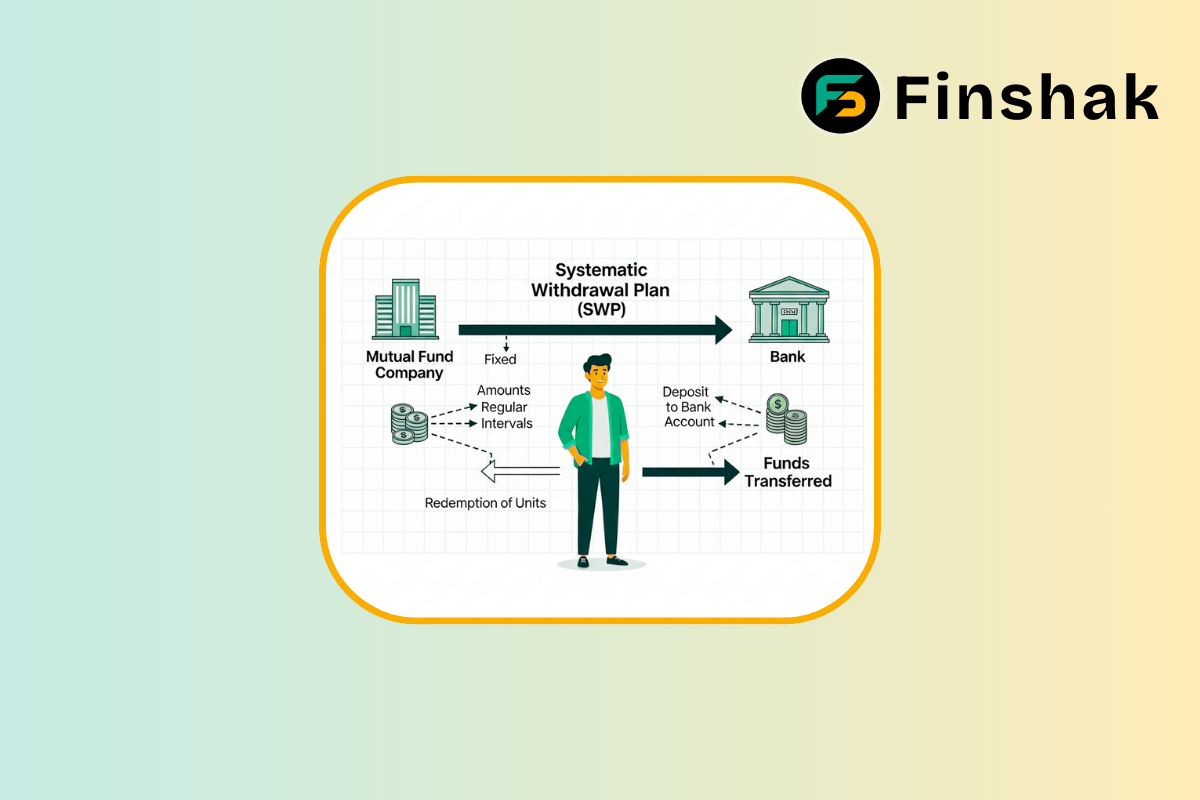

SWP stands for Systematic Withdrawal Plan. This is a concept in which you can invest in mutual funds at once (Lumpsum) or through SIP at a frequency of time, you can also withdraw a certain amount of investment through SWP as per your requirement.

How does SWP work?

When you choose SWP for your mutual fund investment, the fund manager sells certain units of the units you have and deposits that money in your bank account. The period for determining SWP is every week, every month or every three months. If you have invested 20 lakhs in a mutual fund, and you need 10 thousand per month, then the fund manager will sell units worth 10 thousand rupees per month and that amount will be deposited in your account, and also returns on the remaining investment will continue.

What are the benefits of SWP?

Regular Income:

The biggest advantage of SIP is to provide a steady income, this is a great facility for people who are retired.

Benefit of Compounding:

A fixed amount will be withdrawn under SWP but returns will continue to be received on the remaining amount.

Tax Saving:

If a lump sum investment is withdrawn from a mutual fund, then taxes are levied on it, but on the contrary, if an investment is withdrawn under SWP, then no tax will be levied on it.

Rupee Cost Averaging:

Many times, units are purchased at higher prices in the market. Due to Rupee Cost Averaging, a balance is achieved in the purchase price, similarly, RCA is also beneficial in SWP. And on the contrary, if a lumpsum amount is withdrawn, the returns can be lower.

Conclusion:

SWP is a great option to get a steady income, in this the investor can also save tax. SWP is an important aspect of financial planning. This also helps the investor maintain cash flow.

FAQ:

1. What is the 4% rule in SWP?

Ans: If your investment amount is 30 lakh and you are planning for a SWP scheme, then make SIP a maximum of 4% of the Total Amount.

2. Is SWP better than FD?

Ans: SWP is withdrawn from the investments you make, and the returns received are met on the balance investment, so many times there are ups and downs.

3. How much is the charge for SWP?

Ans: There is no charge for the Systematic Withdrawal Plan, but the main charge is on STGT and LTGT on the returns received on the investment.

4. Can I convert my Sip into SWP?

Ans: To get a good amount through SWP, it is necessary to have a good investment. After you have made the right investment according to the fund, SIP can be converted into SWP.

5. What is the main disadvantage of SWP?

Ans: If the returns on your investment are less than the SWP, then your investment will decrease over time.

General Blog

- ICICI Prudential Conglomerate Fund NFO 2025:

- SIP vs Lumpsum: Which Investment Strategy Is Right for You?

- Bharat Bond ETF: Safe Investment Option in India for Stable Returns

- Shariah-Compliant Mutual Funds: Who should Invest?

- Index Funds:Types, Advantages, Disadvantages & Who Should Invest

- Liquid Mutual Funds: Safe, Quick, and Rewarding Investments in 2025-26

- Portfolio Management Services (PMS)? Why is it needed?

- Hedge Funds in India: Definition, How They Work, and its Benefits

- What is Quant Mutual Fund? Meaning, Features, Types, Advantages

- What is a Thematic Fund? Meaning, Benefits, Risks & Examples in India

- Hybrid Mutual Funds: Types, Benefits, and Risks in India

- ITR Filing FY 2024-25 – Is It Mandatory if Income is Below ₹2.5 Lakh?

- What is a Debt Fund? Types, Risks & Benefits Explained

- Mutual Fund Performance and its Metrics

- How to Review Your Mutual Fund Portfolio

- Axis Mutual Fund Front-Running Scam|Who is Viresh Joshi?

- Role of Fund Manager in Mutual Funds

- Importance of Diversification in Mutual Funds

- Mutual Fund Fees – Impact Explained | Finshak

- How to choose the Best Mutual Fund

- How to Start Investing in Mutual Funds

- Risk Involved with Mutual Funds

- Benefits of Investing in Mutual Funds

- What is NAV in Mutual Fund?

- What is a Mutual Fund and ETF?

- What is a Mutual Fund?

- 5 TIPS FOR FINANCIAL PLANNING FOR WOMEN

- Growth V/s Value Investing: Which One To Choose?

- Top 3 Benefits Of Sip In Mutual Funds

Insurance

Mutual Funds

- Future of Investing in India: Specialized Investment Fund (SIF) Explained:

- Exit Load in Mutual Funds Explained: Types, Calculation, and Latest Rates

- Load Mutual Fund vs No-Load Mutual Fund: Which is Better for You?

- Load Mutual Funds vs No-Load Mutual Funds: Which is Better for You?

- The Role of Mutual Funds in Financial Planning: Diversification, Wealth Creation & More.

- What is a Mutual Fund Chain? Components, Process, and Benefits Explained

- TREPS in Mutual Funds: Meaning, Benefits & Why Funds Invest in It

- Expense Ratio in Mutual Funds: Meaning, Calculation & Impact on Returns

- SWP in Mutual Funds: How to Get Monthly Income Like a Salary from Your Investment

- Systematic Transfer Plan Explained with Types & Benefits

- What is SIP? How Does Systematic Investment Plan Work?

- Gold Mutual Funds in India: Benefits, Risks, Returns & Why You Should Invest

- Growth Fund in India 2025: Meaning, Benefits, Risks & How to Invest

- What is an Equity Mutual Fund? | Types, Advantages & Top Funds in India 2025

- TOP Mutual Fund AMC in India

- History of Mutual Fund

Popular Investment Schemes

- Senior Citizen Saving Scheme (SCSS) - Benefits & How to Invest

- Sukanya Samriddhi Yojana (SSY) 2025: Benefits, Eligibility & How to Apply

- Smart Retirement Planning with SIP: Retire Strong, Retire Free

- Post Office Time Deposit: Schemes, Interest rate, Benefits

- Everything You Need to Know About the National Pension Scheme (NPS) in India

- Kisan Vikas Patra Scheme:

- Pradhan Mantri Vaya Vandana Yojana: Secure Your Retirement with a Guaranteed Pension

Product Blog

No posts found in this category.

Stock Market

No posts found in this category.